Vancouver, B.C. – July 16, 2019 - Barksdale Capital Corp. (“Barksdale” or the “Company”) (TSXV: BRO) (OTCQB: BRKCF) is pleased to announce the acquisition of a 100% interest in the San Antonio property (“San Antonio”) from Teck American Incorporated (“Teck”). The San Antonio property is comprised of 315 mineral claims totaling 6,300 acres (2,550 hectares), located approximately five kilometers southeast of Barksdale’s flagship Sunnyside project in Santa Cruz County, Arizona and is immediately adjacent to the southeastern border of South32’s Hermosa project.

Highlights

- The acquisition increases Teck’s equity stake in Barksdale to 9.9% from 8.0%

- The large San Antonio property covers 6,300 acres in 315 mineral claims, more than doubling Barksdale’s land position in the Patagonia district

- Previous work by Teck at San Antonio includes extensive geophysical surveys which outline a shallow IP anomaly, designated the Cosmos target, that Barksdale interprets as a potential shallow buried copper porphyry

Barksdale’s President and CEO, Rick Trotman commented, “In addition to our key land position at Sunnyside, the San Antonio acquisition is the next major step in Barksdale’s effort to consolidate its holdings in the greater Patagonia district. The San Antonio property provides Barksdale shareholders with additional exposure to this world-class mineral trend and, more specifically, to a potential copper porphyry target that has been outlined over several successive campaigns of geologic and geophysical studies.”

San Antonio Technical Details

The San Antonio property encompasses the southern extension of the Harshaw Fault, which is thought to be a key controlling structure for the emplacement of multiple mineralized systems within the district. The Harshaw Fault can be traced over a length of at least 12 kilometers including its projected surface trace beneath thin post mineral gravel cover in the southern portion of the district. The Cosmos porphyry target, located in the central portion of the San Antonio property, is interpreted to occur on the eastern flank of the Harshaw Fault.

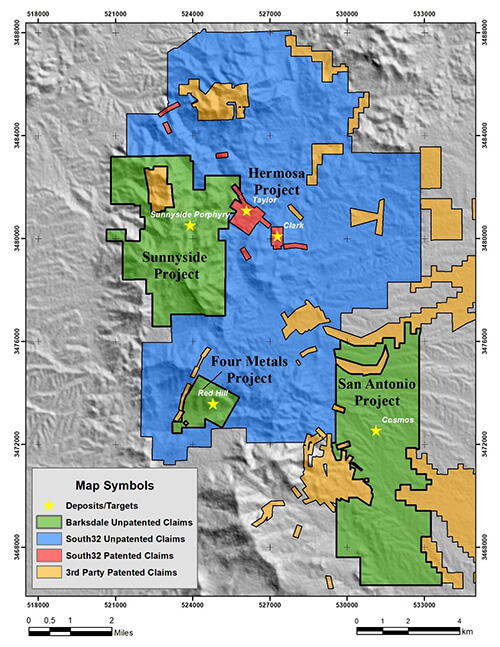

Figure 1. Patagonia District Mineral Claim Map.

While multiple copper porphyry deposits have been discovered within the Patagonia district, including the Ventura, Sunnyside, and Red Mountain deposits, all have been shown to be deeply buried. Work completed to date suggests that the Cosmos target is shallow, starting at 100 meters depth, and located under a thin pediment of Ternary gravel cover which has masked any surficial indications that would have led to its discovery through traditional prospecting methods. The property has never been drilled.

Extensive work has been completed on the San Antonio property, including geologic mapping, geochemical sampling, and multiple geophysical surveys including passive seismic, gravity, induced potential (IP), and airborne magnetics.

Barksdale’s technical and permitting teams are designing a drilling program to test the Cosmos target as well as a Plan of Operations that will be submitted to the USFS in due course.

Terms of the San Antonio Purchase Agreement

Under the terms of a Purchase Agreement dated July 15, which is subject to TSX Venture Exchange acceptance, Barksdale will acquire a 100% interest in San Antonio in consideration for 898,809 Barksdale shares as well as reimbursement of 2019-2020 federal claim maintenance fees totaling approximately US$52,000. Additionally, Teck will retain a one and a half percent 1.5% net smelter return royalty (“NSR”) on future production as well as a right of first refusal over San Antonio. Except for the royalty in favor of Teck, the San Antonio property is not subject to any pre-existing royalties. All shares issued to Teck will be subject to a four month hold period.

Following closing of the Acquisition, Teck will hold approximately 9.9% of Barksdale on a non-diluted basis with a total of 4,308,604 shares.

Technical information in this news release has been reviewed and approved by Lewis Teal, Senior Consultant to the Company and a ‘Qualified Person’ as defined under Canadian National Instrument 43-101.

Barksdale Capital Corp. is a base metal exploration company headquartered in Vancouver, BC, that is focused on the acquisition and exploration of highly prospective base metal projects in the United States. Barksdale’s portfolio of assets is located within a world-class base metal district in southern Arizona and is surrounded by some of the world’s largest mining companies.

ON BEHALF OF BARKSDALE CAPITAL CORP

Rick Trotman

President, CEO and Director

604-398-5385

Terri Anne Welyki

Vice President of Communications

778-238-2333

For more information please phone 604-398-5385, email

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this news release.

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING INFORMATION: This news release includes “forward-looking information” under applicable Canadian securities legislation including, but not limited to, the anticipated acquisition of San Antonio and its prospective trends, targets and mineralization. Such forward-looking information reflects management’s current beliefs and are based on a number of estimates and assumptions made by and information currently available to the Company that, while considered reasonable, are subject to known and unknown risks, uncertainties, and other factors which may cause the actual results and future events to differ materially from those expressed or implied by such forward-looking information. Readers are cautioned that such forward-looking information are neither promises nor guarantees, and are subject to known and unknown risks and uncertainties including, but not limited to, general business, economic, competitive, political and social uncertainties, uncertain and volatile equity and capital markets, lack of available capital, actual results of exploration activities, environmental risks, future prices of base metals, operating risks, accidents, labor issues, delays in obtaining governmental approvals and permits, and other risks in the mining industry. In addition, the close proximity of San Antonio to the historic Washington Camp – Duquesne base metal district is not necessarily indicative of the mineralization at San Antonio. There are no assurances that the Company will successfully complete the acquisition of San Antonio on the terms set out herein or at all. All forward-looking information contained in this news release is qualified by these cautionary statements and those in our continuous disclosure filings available on SEDAR at www.sedar.com. Accordingly, readers should not place undue reliance on forward-looking information. The Company disclaims any intention or obligation to update or revise any forward-looking information, whether as a result of new information, future events or otherwise, except as required by law.

THIS NEWS RELEASE, REQUIRED BY APPLICABLE CANADIAN LAWS, IS NOT FOR DISTRIBUTION TO U.S. NEWS SERVICES OR FOR DISSEMINATION IN THE UNITED STATES, AND DOES NOT CONSTITUTE AN OFFER TO SELL SECURITIES AND THE COMPANY IS NOT SOLICITING AN OFFER TO BUY THE SECURITIES DESCRIBED HEREIN. THESE SECURITIES HAVE NOT BEEN REGISTERED UNDER THE UNITED STATES SECURITIES ACT OF 1933, AS AMENDED, OR ANY STATE SECURITIES LAWS, AND MAY NOT BE OFFERED OR SOLD IN THE UNITED STATES OR TO U.S. PERSONS UNLESS REGISTERED OR EXEMPT THEREFROM.